Life Insurance is not an Investment Class

Lately, I hear a lot of people saying ‘I have invested in insurance’ or ‘Insurance is not a very good investment’.

In short, life insurance has been put in the same category as real estate, stocks, bonds, and gold. This shows that we still have a long way to go when it comes to financial literacy and insurance literacy specifically.

I would like to take this moment to clarify; that LIFE INSURANCE IS NOT AN INVESTMENT CLASS!!!!! Have you heard me clearly there at the back?

Side note:

Life insurance is an investment in every sense of the word towards your life and those depending on you. It is similar to saying that a holiday is an investment. We know a holiday is not an asset class at all but it is still an investment to you because you get to recharge and it is good for your mind and body

Life insurance and investments are two very different financial tools.

Life insurance is a risk tool that protects your loved ones against your loss of income, i.e. your economic value when you pass on and an investment is a tool to grow and multiply your money. They are both important in your financial plan but play different roles to help you reach you and your family’s financial goals.

I cannot blame you for getting these policies because most of the ‘life insurance’ products in the market are actually sold as investments. These insurance products that double up as investments are extremely popular.

You know, for the sake of convenience or the fact you do not want to think about death, you would rather buy a cover which has ‘maturity’ at the end of the term. This means they get some sort of return if you are still alive by the end of the term.

They come in so many different names depending on what gets you excited, this could be education policy, endowment policy, money back policy. They all have the insurance and investment components.

It’s very interesting that many people, maybe including you, could be getting this policy because talking or even thinking about death makes you feel some type of way. Whether you like it or not, when you buy these products they still have the term life insurance part that you have been avoiding.

Investments

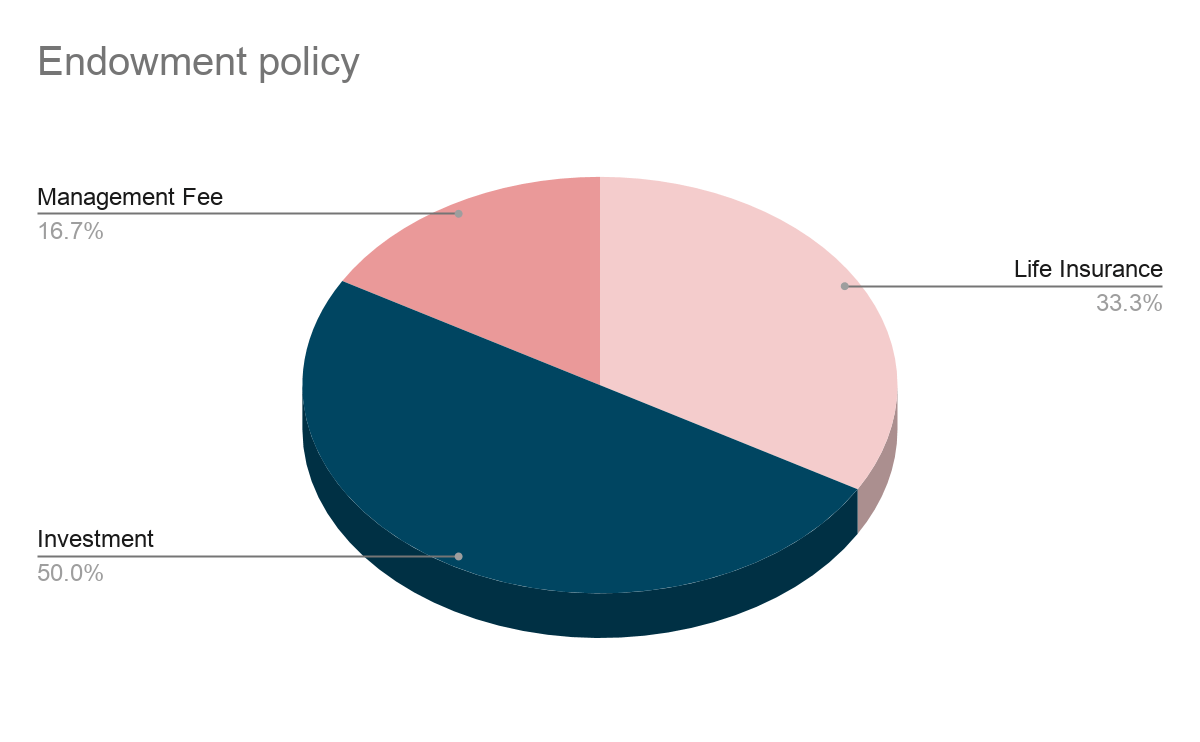

Please note that the pie chart above is for illustration purposes only.

Different insurance companies do it differently. But you get the point. Out of every premium you pay, the amounts are allocated to:

-

Life insurance

-

Savings/ Investment

-

Management fees and other expenses

(If you are still at the place of ‘so life insurance is not the same as an ‘investment?’ please go to the previous blog posts here and here)

Would you take an endowment policy?

Personally, I would avoid an endowment policy like the plague.

They have expensive charges and are also very inflexible in that you are locked in for the selected period, usually suffering heavy losses if you need to come out early.

Here are 5 reasons why I would not touch these endowment policies with a ten-foot pole:

-

It is not clear how much of the money I contribute goes to life insurance

-

It is not clear how much of the money I contribute goes to investment

-

I don't how much I will be spending on the fund manager’s fees

-

I don't know how they are investing my money

-

It is simply too opaque for me

In the following series of ‘is your endowment policy a joke,’ you will understand why I can never touch these policies or even advise my clients to get it.

I just can’t.